Why do people of faith and charitable nonprofits want to keep the Johnson Amendment? BJC Executive Director Amanda Tyler and Tim Delaney, President and CEO of the National Council of Nonprofits, talk about this provision of the tax code that protects nonpartisanship in 501(c)(3) organizations. They review how people of faith and the nonprofit community are working to keep the Johnson Amendment, and they share how you can join them. Don’t miss their review of the threats to the law throughout 2017 and what they expect in 2018 and beyond.

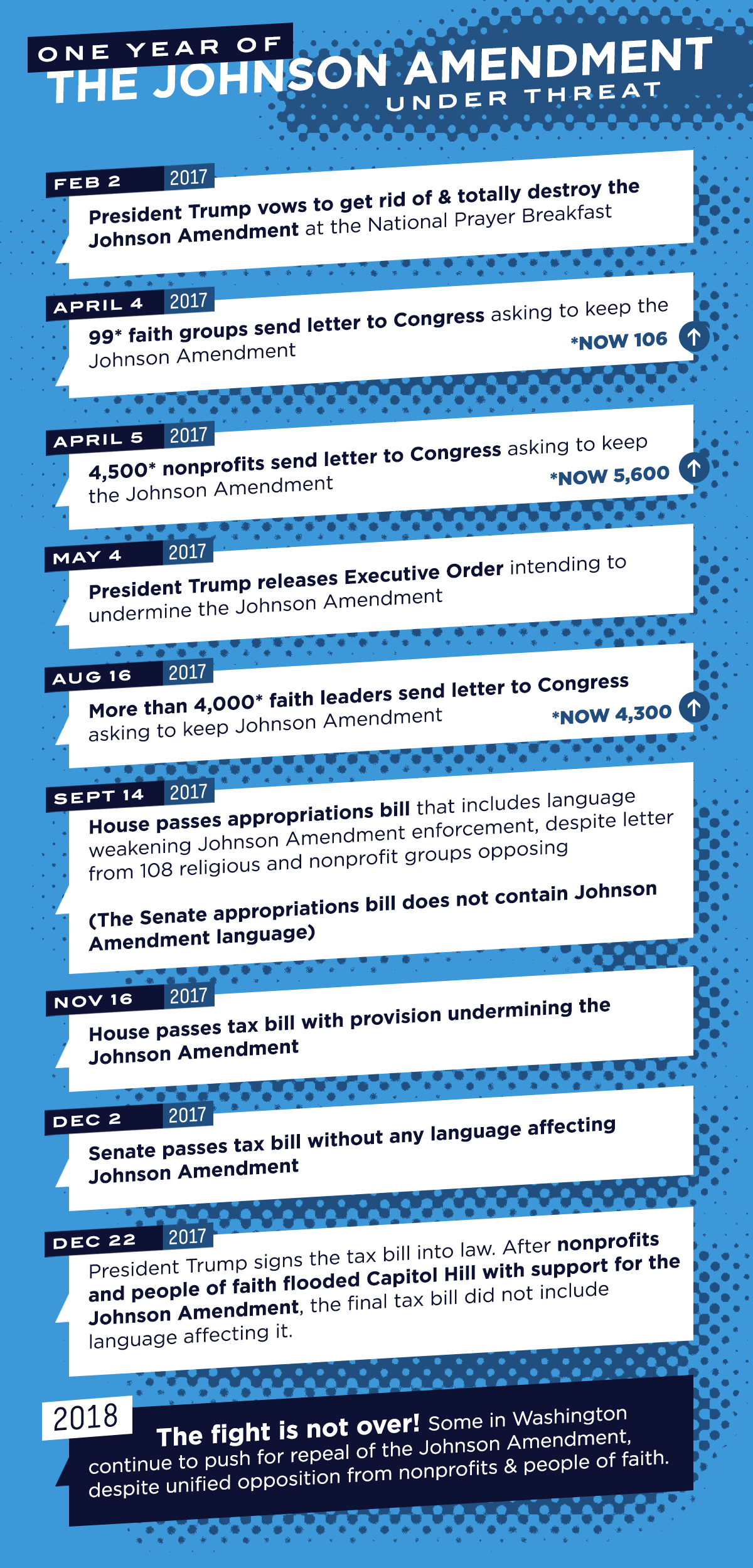

Podcast guide: Go to 4:30 to hear the timeline of 2017, and go to 20:51 to hear the threats they expect next.

Links mentioned in this podcast:

Baptist Joint Committee for Religious Liberty: BJConline.org

National Council of Nonprofits: councilofnonprofits.org

Read and join the letter from nonprofit organizations: GiveVoice.org

Read and join the letter from faith leaders: Faith-Voices.org

Learn more about the letter from religious and denominational organizations: BJConline.org/CommunityNotCandidates

To subscribe to the BJC’s email list: BJConline.org/Subscribe

To subscribe to the National Council of Nonprofits’ newsletter: CouncilofNonprofits.org/connect

For background on the Johnson Amendment, visit the BJC’s resource page and the National Council of Nonprofits’ resource page.

Head to iTunes for more BJC podcasts, and scroll down for a graphic with a timeline of 2017’s threats to the Johnson Amendment. For more on the Johnson Amendment, listen to a podcast about the issue with the Rev. Dr. Stephen Cook of Second Baptist Church in Memphis, Tennessee.

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS